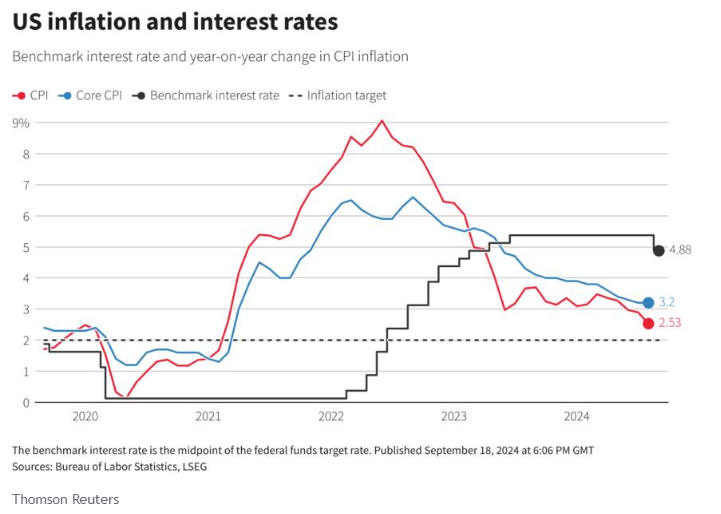

Wall Street’s main indexes advanced after the Federal Reserve kicked off its monetary easing cycle this Wednesday with a half-a-percentage point reduction and forecast more interest rate cuts were on the horizon. The positive news is that the Fed forecast rates to fall by another 50 bps by the end of 2024 year, and unveiled macroeconomic projections that analysts say reflect steady growth and lower unemployment.

The Federal Open Market Committee lowered the benchmark Fed funds rate to a range of 4.75% to 5%, the first reduction since March 2020, signaling confidence in the progress made against inflation. Fed officials are confident that inflation is no longer a major threat, allowing them to support other economic objectives, like boosting employment or encouraging investment. This move reflects the bank’s belief that the economy can handle lower borrowing costs without overheating.

See Related: U.S. Central Bank May Need To Keep Interest Rates Higher For Longer. What To Expect In The Upcoming Days?

Growth And Inflation Risks

This balance also reassures investors that growth is possible without spiraling inflation risks, which can further support stock market advances. It is also important to mention that lower interest rates reduce borrowing costs for consumers, making things like mortgages, car loans, and credit card debt cheaper. This encourages spending, which fuels economic growth and benefits companies’ bottom lines, leading to stock market gains. Bret Kenwell, investment analyst at eToro, said:

“Markets are acting well to yesterday’s messaging from the Fed. They wanted to hear we weren’t falling into recession which Chair Powell reassured that the economy is on good footing. A soft landing is still in play; that’s still the default expectation. However, there’s still clearly some concern that the labor market is going from a period of softness to weakness”

According to the CME Group’s FedWatch tool, traders are now betting on a 61.1% chance that the Federal Reserve will cut interest rates by 25 basis points at its upcoming November meeting. Despite this, some analysts are not positive and according to them the strong signal from the Federal Open Market Committee is probably that they are more concerned about the risks facing the outlook for the US economy.

Scotiabank’s head of capital markets economics, Derek Holt, said that even though the Fed has started easing, past rate hikes are still having effects. This could put pressure on businesses in the upcoming quarters, potentially leading to layoffs or cost-cutting measures, which would hurt economic growth.