After months of uncertainty, global central banks appear to be slowly aligning on one message: rate cuts are coming, but not too fast. The U.S. Federal Reserve, European Central Bank, and other major financial institutions are signaling a cautious approach as they try to balance slowing economic growth with lingering inflation concerns.

The Federal Reserve kicked off the latest round of moves this week by cutting its key interest rate by a quarter point. But Chair Jerome Powell made it clear that more cuts aren’t guaranteed, especially with the U.S. government shutdown making it harder to predict the economy’s direction. Powell explained the situation simply: if you’re driving in the fog, you slow down. That statement sums up how most major central banks are thinking right now, careful, patient, and uncertain.

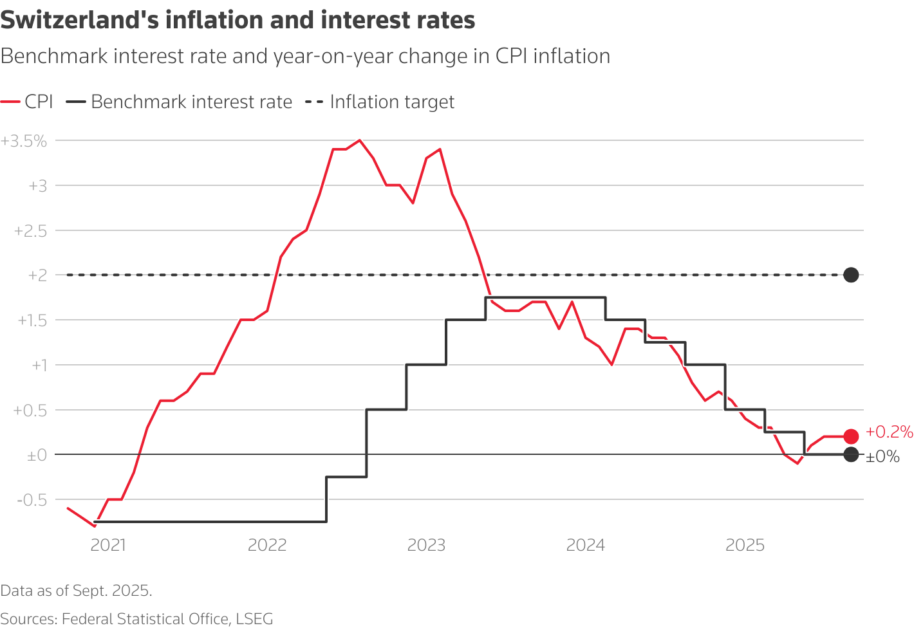

1. Switzerland

The Swiss National Bank (SNB) cut its key interest rate to 0% in June and is now expected to hold steady for some time. In recently published minutes, the SNB dismissed market speculation that it would return to negative rates to counter the strong Swiss franc. The central bank remains cautious, trying to prevent the economy from slipping into deflation while managing pressure from its strong currency, which has made exports less competitive.

See Related: The Federal Reserve Initiated Its Monetary Easing Cycle By Implementing A Half-Percentage Point Interest Rate Cut

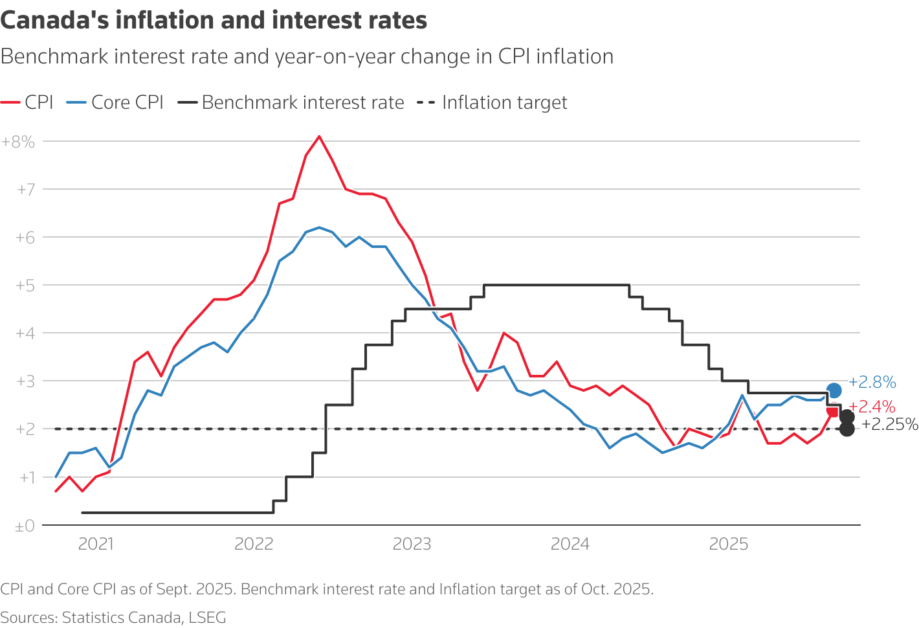

2. Canada

The Bank of Canada lowered its interest rate to 2.25% this week, the lowest level in more than three years. The move aims to ease the effects of an economic slowdown worsened by U.S. tariffs and the inflationary impact of global trade tensions. However, Canadian policymakers have hinted that this may be the end of their easing phase. Markets currently expect the central bank to hold rates steady until at least the end of 2026.

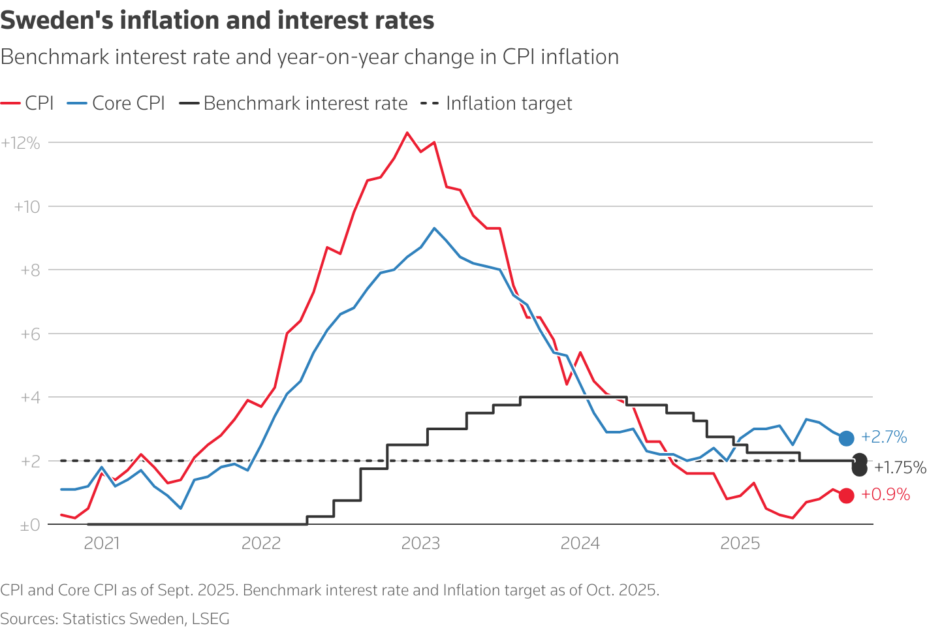

3. Sweden

Sweden’s Riksbank last month cut its benchmark rate to 1.75% and signaled that high inflation could prove temporary. Investors believe the central bank is unlikely to reduce rates further before 2026. Sweden’s currency, the krona, has surged about 15% against the U.S. dollar so far this year as markets grow more confident that the Riksbank will hold firm.

4. New Zealand

The Reserve Bank of New Zealand (RBNZ) made one of the boldest moves among developed economies by cutting rates by 50 basis points to 2.5%. The decision was meant to support a weakening economy. Still, inflation remains near the upper end of the RBNZ’s 1-3% target, which could limit its ability to cut again. Markets expect one more possible reduction later this year if economic data worsens.

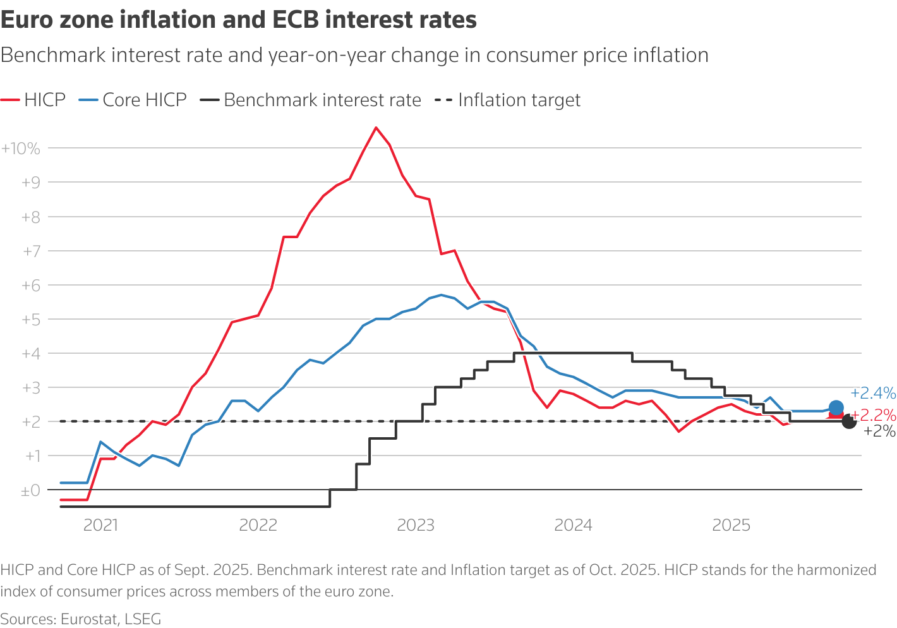

5. Euro Zone

The European Central Bank (ECB) decided to keep its main deposit rate unchanged at 2% for the third consecutive meeting. Traders believe the ECB’s easing cycle is nearing its end, with less than a 50% chance of another cut before mid-2026. The bank’s cautious stance reflects concerns about inflation, which remains higher than desired in several European countries despite slowing growth.

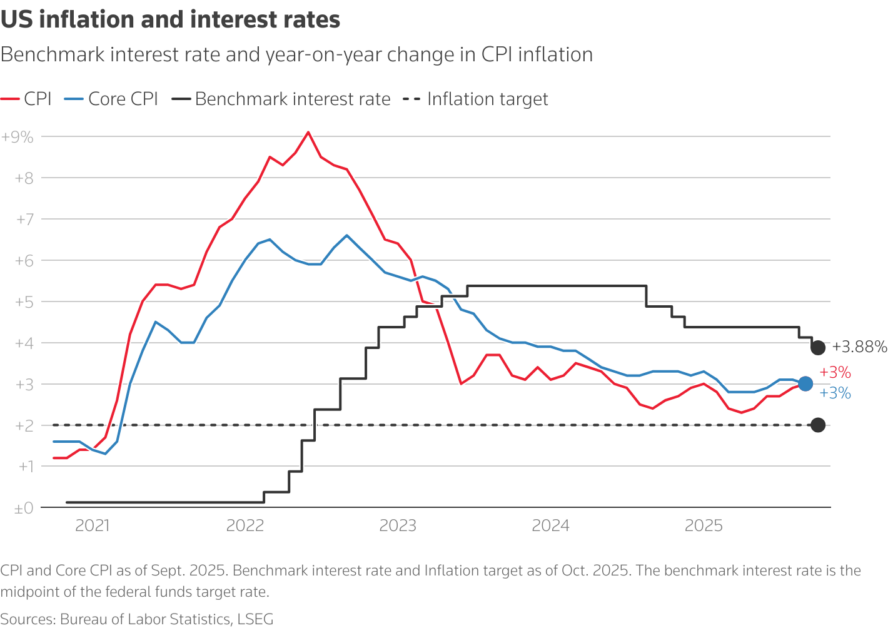

6. United States

The U.S. Federal Reserve reduced interest rates by 25 basis points this week, a widely expected move. However, officials emphasized that further cuts will depend on economic data, which is currently difficult to assess due to the ongoing government shutdown. Two Fed policymakers disagreed with the decision, one calling for a larger cut and another opposing any reduction at all. Markets now see a 70% chance of another small cut in December, down from earlier expectations of 84%.

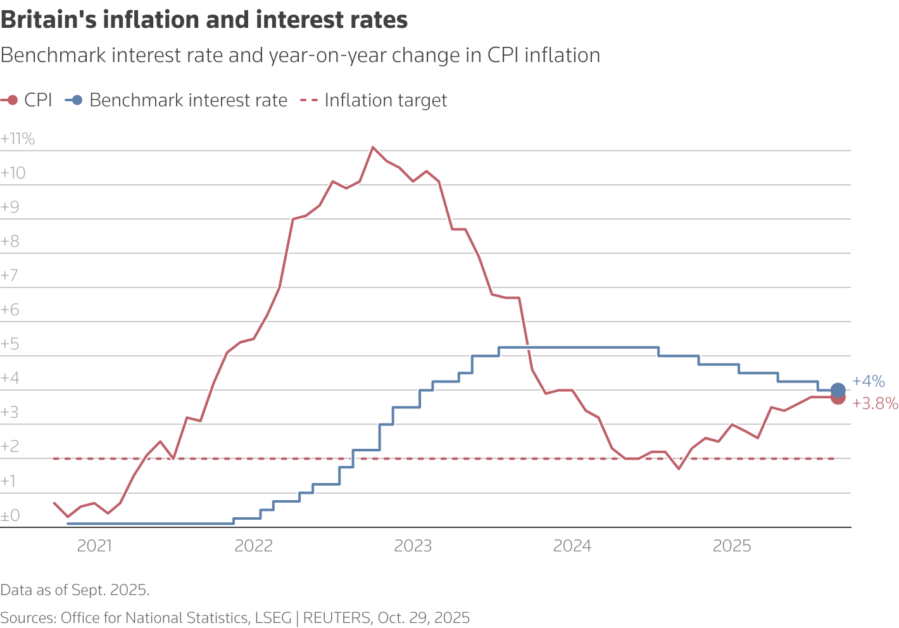

7. Britain

The Bank of England (BoE) has maintained its interest rates amid persistent inflation concerns. While traders expect another hold at the next meeting in early November, there’s growing anticipation of a possible cut in December if price pressures ease. Inflation in the UK remains above the central bank’s target, but steady prices in recent months have given officials some breathing room.

8. Australia

The Reserve Bank of Australia (RBA) has been among the most active in cutting rates, reducing them by a total of 75 basis points since February. However, after recent inflation came in hotter than expected, the RBA shifted to a more cautious tone and decided to pause. Markets now believe the next rate cut is unlikely before February 2026, signaling confidence that the bank will prioritize inflation control over further easing for now.

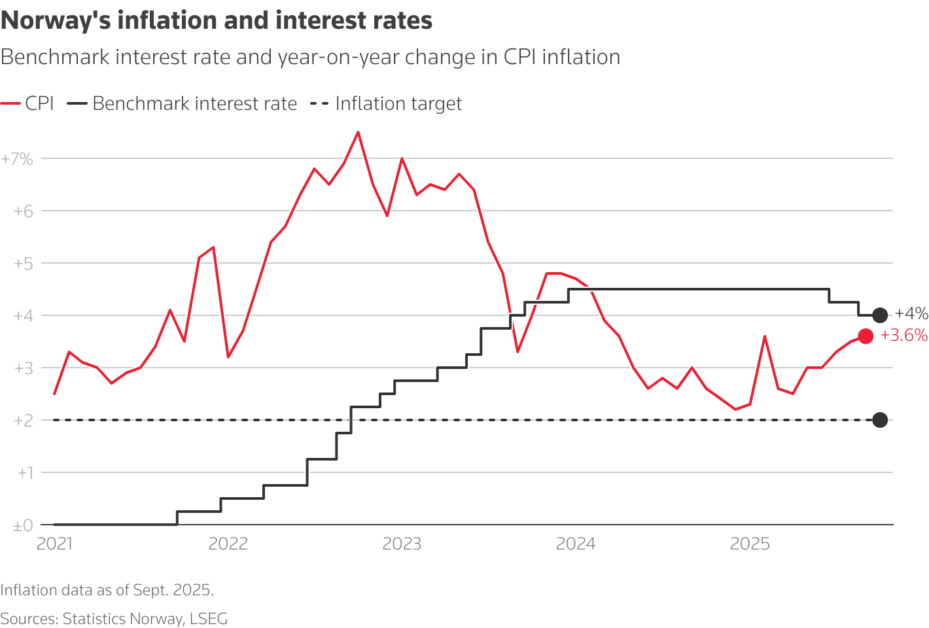

9. Norway

Norway’s central bank trimmed its key borrowing rate to 4% in September but hinted that more cuts are unlikely soon. Rising inflation has prompted policymakers to remain cautious, helping the Norwegian krone strengthen about 12% against the U.S. dollar this year. The country’s strong energy exports and careful monetary management have made its currency one of the better performers in Europe.

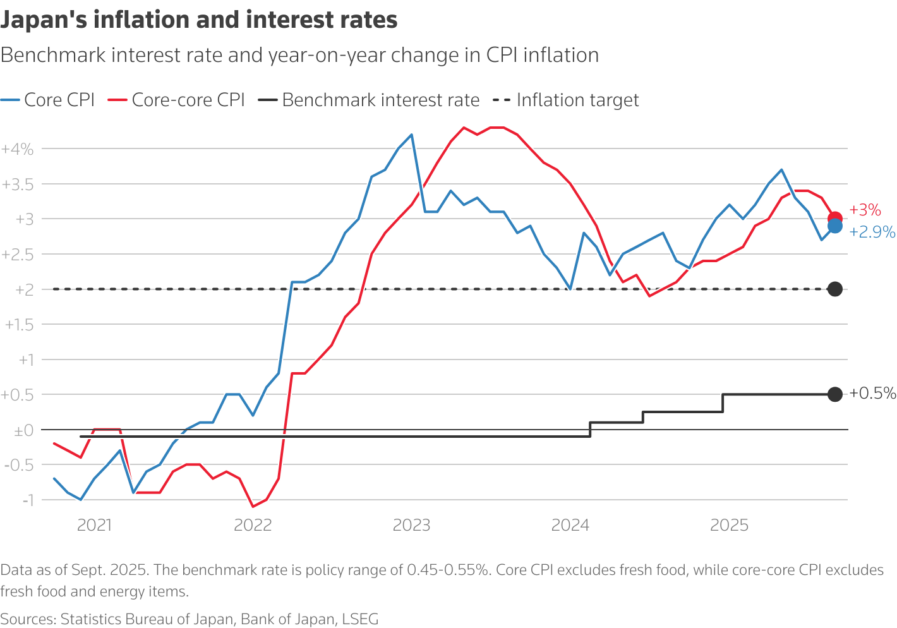

10. Japan

The Bank of Japan (BOJ) remains the only major central bank still on a tightening path. It kept rates unchanged this week but reiterated its commitment to gradually raising borrowing costs if the economy continues to grow as projected. The Japanese yen weakened slightly after the announcement. Meanwhile, U.S. Treasury Secretary Scott Bessent urged Japan to raise rates faster to prevent the yen from falling too much.

A Global Pattern of Caution

Across the world, central banks are moving with restraint. While inflation has eased from last year’s highs, it remains a concern in many economies. Growth, on the other hand, is slowing. This delicate balance has pushed policymakers to act carefully, lowering rates just enough to support growth without reigniting inflation.

The global message is clear, the era of aggressive tightening is over, but the road to lower rates will be slow and cautious.