Ben Phillips is a UK-based influencer who got involved in the SafeMoon project early on. Phillips joined the team as chief of marketing and used his platforms to promote the SafeMoon token while simultaneously selling his holdings, this is called a pump and dump.

Fellow YouTuber Stephen Findseisen, known as Coffeezilla published a video covering the whole ordeal. The story was bought to light by a whistleblower as Findseisen explains.

Although Phillips runs a YouTube ‘prank’ channel, he would publicly claim he has ‘diamond hands’ for holding onto SafeMoon through the dips, urging his 749,000 Twitter followers to “buy the dip”. In turn, his ‘diamond hands’ lost their shine as he was pumping the coin right before selling his holdings off for millions in profit.

The Cover Is Blown

After Phillips leaked his own BSC wallet address by asking his followers to buy him Starbucks, his ulterior motive started to show. With his address users are able to use a blockchain explorer to see all transactions linked to his specific wallet.

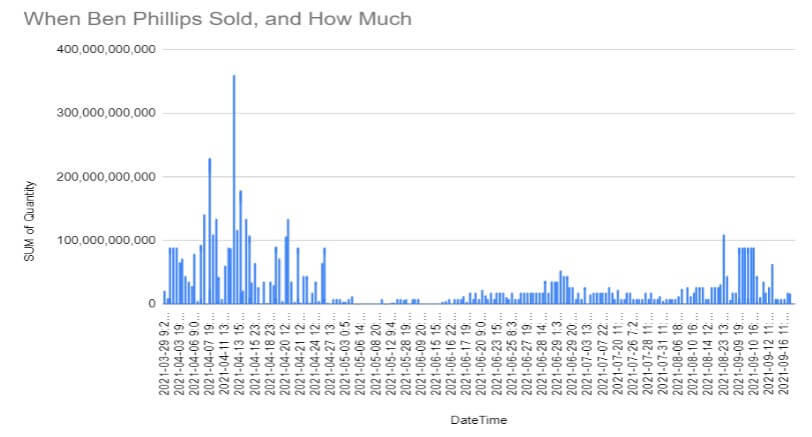

Findseisen carried out a detailed analysis of the wallet and found many dates where he seemed to pump the coin via Twitter, and then go on to sell.

The Pumps And The Dumps

On April 6th 2021, Philips tweeted how he was so proud to be a part of the journey with his SafeMoon family after they reached 300k holders, and then proceeded to sell $7K, $100K, $113K, and $156K worth of SafeMoon.

On April 13th, 2021 Phillips tweeted “Diamond hand phillips! ??? #RESPONSIBLEWHALESMATTER” he then sold off another $10K, $59K, and $91K.

One of Phillips bigger dumps was on April 20th 2021 after he tweeted “Diamond hands ? always win!”. He sold off $33K , $748K, and $755K worth of SafeMoon.

Findeisen concluded his analysis with detailed calculations of the huge profits that Phillips gathered thanks to his dumps;

SafeDangerousMoon

Only 10 months ago analysts of SafeMoon were warning investors of their concerns with SafeMoon being a ’pump and dump’. To add, a recent class-action lawsuit was filed in the U.S. District Court in California against SafeMoon and its promoters including; celebrity promoters and its executive officers. The lawsuit accuses SafeMoon’s tokens of being a ’Ponzi-like Pump and Dump scheme’.

Along with this, SafeMoons VP Charles Karony announced he was leaving the project to go back to school, but made sure to praise the community for their achievements.