The U.S. stock market’s weakness in recent days is connected with robust U.S. economic growth, which suggests that the Fed will probably keep high interest rates for a longer period. Strong economic data caused investors to dial back expectations of rate cuts, although the Fed has made significant progress in cooling consumer prices.

The latest economic data showed that industrial production in the U.S. rose more than expected in July, and the Federal Reserve announced that industrial output increased by 1% in July from June’s downwardly revised decline of 0.8%. The pace of growth was above the expectation for an increase of 0.3%, while strong retail sales numbers that were released this week also confirmed the U.S. economy’s resilience.

Because of this, the GDPNow estimate for real GDP growth that the Atlanta Fed produces rose to 5.8% for Q3 last Wednesday, up from 5.0% the prior day and 3.9% on Aug. 1. This is more than double the pace the Commerce Department first projected for the second quarter, however; many analysts see this like bad news for a stock market that is expecting the Fed to cease its tightening.

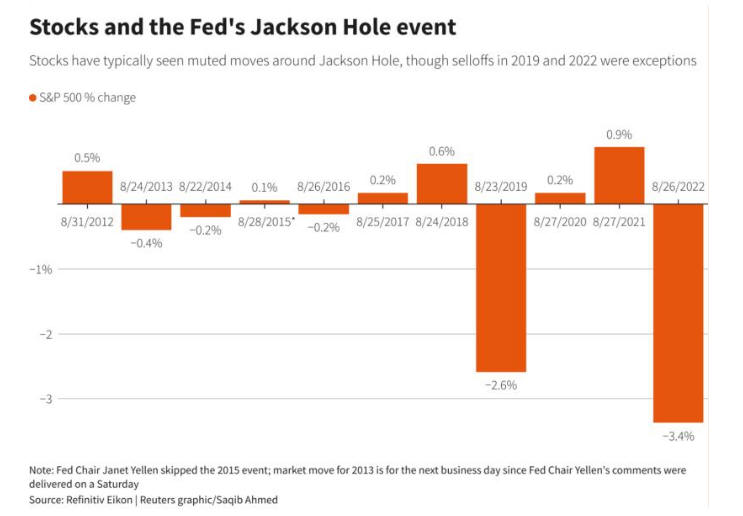

This week’s main event will be the Federal Reserve’s economic symposium at Jackson Hole this Friday, and Fed Chair Jerome Powell is expected to give his address on monetary policy at 10:05 a.m. ET (14:05 GMT). It is important to say that a more hawkish-than-expected message from Fed Chair Jerome Powell at Jackson Hole last August sank the S&P 500 by -3.4%, and analysts at Bank of America believe that the U.S. stock market is probably not prepared for a hawkish message from Powell again.

Barring the market drop in August 2022 and a 2019 tumble, Fed chairs’ Jackson Hole speeches have not been big market movers in recent years, but there may be greater scope for market gyrations this time around. Analysts at Bank of America reported:

“Fading expectations of recession have brought the focus back to inflation and a potential tight Fed … and risk assets have started showing more signs of weakness than at any other point this year. We therefore think equities are more at risk of a macro-driven shock than the market is pricing in.”

To be sure, there’s little guarantee that Powell’s message will be a starkly hawkish one, but investors should keep in mind that inflation remains above Powell & Co’s average annual 2% target. Fed officials repeated several times this month that they will continue with the effort to bring inflation down closer to their 2% annual target. The federal funds rate is now in a range of 5.25% to 5.5%, which is the highest level in 22 years, and in the days ahead, stock and cryptocurrency markets will be hypersensitive to any FED comments.