- US to enter mild recession despite Fed’s rate hike to tackle high inflation.

- Central banks change interest rates to boost growth or curb inflation, but higher rates can decrease demand, causing layoffs and unemployment.

- The impact of rate changes is complex, potentially cooling housing demand but boosting savings.

Financial markets worldwide are abuzz with talk of the US Federal Reserve’s (Fed) upcoming decision to raise its benchmark lending rate to tackle high inflation. However, many economists are concerned that this move could exacerbate the slowdown in the American economy, potentially leading to a mild recession later this year.

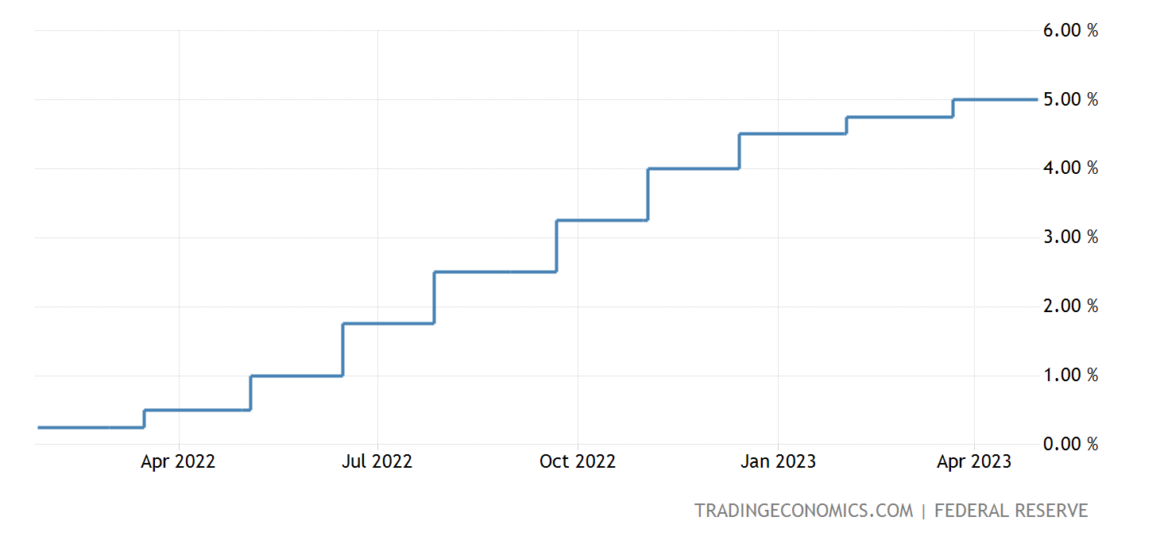

Despite the growing economic slowdown, the Fed is expected to raise interest rates by 25 basis points, marking its tenth-rate hike in a row. This move would bring the benchmark to between 5 and 5.25 percent, its highest level since 2007.

Recent US economic data suggests a slowing economy, with predictions of a recession later this year. For example, economic output slowed to an annual rate of 1.1 percent in Q1 2023, while the Fed’s favoured measure of inflation fell to an annual rate of 4.2 percent in March, down from 5.1 percent the previous month.

Why Do Central Banks Change Interest Rates?

Central banks change interest rates for various reasons, such as to reinvigorate economic activity and growth during a slowdown or to keep inflation in check. Interest rate changes can impact many facets of the economy, including mortgage rates, home sales, consumer credit, and stock market movements.

Impact Of Raising The Prime Rate

When the Fed raises interest rates, the prime rate (Bank Prime Loan Rate) also jumps, leading to higher credit card and other loan rates based on individual risk profiles. Short-term borrowing will have higher rates than long-term borrowing. Meanwhile, fixed-income investors may see a negative impact on their investments.

Cost Of Borrowing Will Increase

Higher interest rates also increase the cost of borrowing money, leading to a decrease in demand for goods and services. This, in turn, can cause businesses to cut back on production, potentially leading to layoffs and increased unemployment.

Savings May Grow, But The Housing Sector May Face A Slowdown

However, the banking sector may benefit from higher interest rates since they can earn more money on the dollars they loan out. Money market and certificate of deposit (CD) rates may also increase, boosting savings among consumers and businesses. Higher interest rates may also cool demand in the housing sector, but they may not be as effective at reducing consumer impulse purchasing.

All Eyes On The United States

Overall, the impact of interest rate changes on the economy is complex and multifaceted. While higher interest rates can help tackle inflation, they can also exacerbate a slowdown in the economy and lead to a recession. As the Fed prepares to make its decision, the financial world will closely monitor the situation to see how the US economy will be affected.