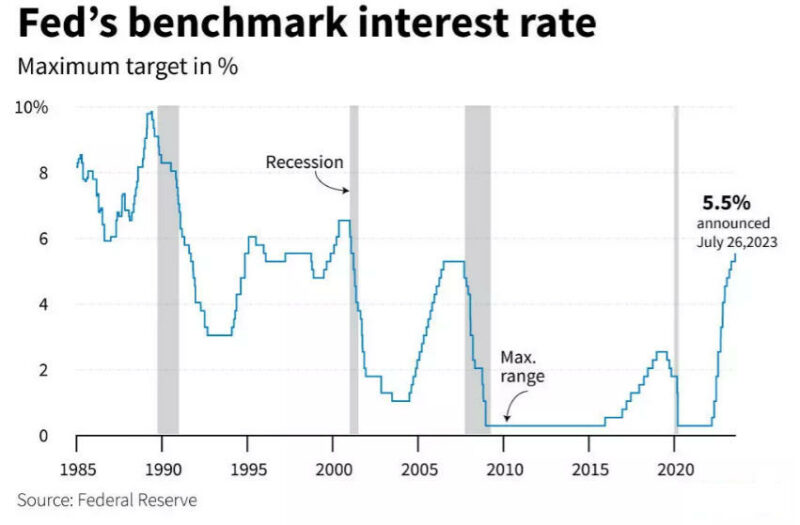

The Federal Reserve is widely expected to leave interest rates at 5.25%-5.50% level this Wednesday, and there is a growing likelihood that interest rates will also stay unchanged at its next meeting in November. However, some analysts say that rate hikes are not completely off the table for the rest of the year. Because of this, investors will observe comments from Federal Reserve officials that could give more insight into the path of interest rates.

Analysts from American multinational independent investment bank and financial services company Stifel said that they expect that the majority of Fed members continue to expect at least one additional rate increase in 2023 after the ‘hot’ August inflation report broke a string of three consecutive months of easing inflation pressures in the United States. Inflation remains above Powell & Co’s average annual 2% target, while the U.S. economy has proven more resilient than analysts previously expected.

Federal Reserve Chair Jerome Powell also recently warned that the U.S. central bank is “prepared” to increase interest rates further if needed, and the main question remains how long the Federal Reserve will keep rates at restrictive levels. Michael Green, chief strategist at Simplify Asset Management in Philadelphia, said:

“What’s being priced into the market is a pause but increased risk that rates will stay higher for longer. If the Fed announced that they are removing rate cuts in 2024 by raising the dot plot, it would generally be seen as a very hawkish pause and negative news for riskier assets.”

Higher rates encourage saving over spending and make the debt more costly, and companies that have a bigger credit or other loans with variable interest rates could be in a difficult situation. Higher borrowing costs can hurt corporate profits and discourage businesses from borrowing to invest in new projects, which can harm economic activity and job creation.

This situation usually negatively affects stock prices, and it is also important to mention that high-interest rates make fixed-income investments, such as bonds, more attractive compared to stocks. As a result, investors may shift their money away from stocks, leading to a decrease in stock prices. Stocks aren’t the only assets that could significantly lose their value, and investors should keep in mind that cryptocurrencies could also be in the situation to make an even more significant fall. The crypto market displayed a high correlation with U.S. equities, and if a downtrend is witnessed in the stock market, the same is usually replicated in the crypto-sphere as well.