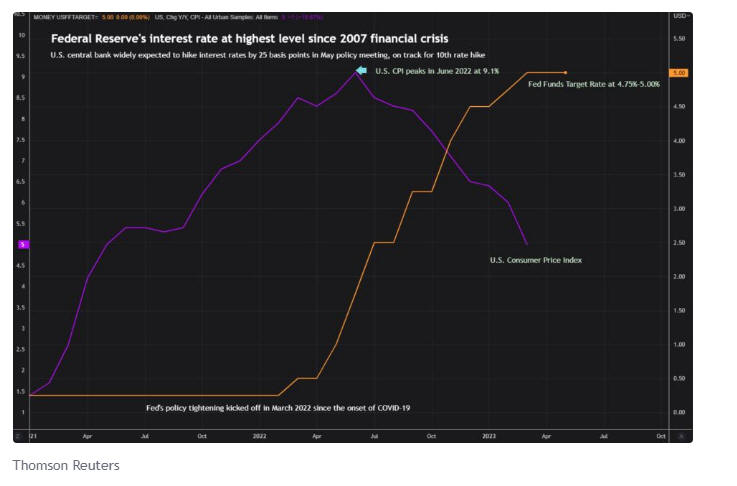

As widely expected, the U.S. Central Bank raised interest rates by 25bps this Wednesday. It signalled it could pause further increases, giving officials time to assess the fallout from recent bank failures, wait on the resolution of a political stand-off over the U.S. debt ceiling and monitor the course of inflation. The federal funds rate is now in a range of 5% to 5.25%, which is the highest level since 2006.

The U.S. Central Bank warned that tighter credit conditions for households and businesses are expected to affect economic activity. In the picture below, we can see that even without this rise in interest rates, the federal funds rate was at the highest level since the 2007 financial crisis.

Many analysts and economists are worried that the high-interest rates will push the economy into a recession. It is important to mention that government data showed last week that economic growth in the first quarter slowed sequentially, with real gross domestic product increasing at a 1.1% annual pace, compared with a 2.6% gain in the prior three-month period. With higher interest rates, companies need to spend more money to borrow money to invest in growth. Historically, higher rates lead companies to reduce spending (especially on hiring).

Many companies could face liquidity problems, and economist David Rosenberg has warned that the U.S. economy is facing two big risks. David Rosenberg said:

“We have a possible debt default on our hands and a spreading bank crisis. The banking turmoil that started with Silicon Valley Bank’s collapse in March remains unresolved, and First Republic’s failure and takeover by CEO Jamie Dimon’s JPMorgan has reignited worries about broader financial instability. Moreover, political disagreement about raising the U.S. government’s borrowing limit is fanning fears of a debt-ceiling crisis.”

See Related: United States May Fund Its Deficit By Printing More Money; Could Default By June 1st

Higher rates encourage saving over spending and make the debt more costly. Companies with bigger credit or other loans with variable interest rates could be in a difficult situation. We expect to see a meaningful slowdown in economic growth and a weakening of the labour market in the United States in the upcoming months.

At the same time, Brian Jacobsen, chief economist at Annex Wealth Management, said that the manufacturing and housing sectors are in a recession already. The famous investor Jeremy Grantham warned that the U.S. stock market could experience significant losses soon, and a recommendation is that investors should continue to take a defensive investment approach.

Stocks aren’t the only assets that could significantly lose their value. Investors should remember that cryptocurrencies could also be in the situation to make an even bigger fall. The crypto market displayed a high correlation with U.S. equities. If a downtrend is witnessed in the stock market, the same is usually replicated in the crypto-sphere.

See Related: Bitcoin Is Close To Testing $30,000 Again; Ethereum Revives Bullish Momentum Above $1,800