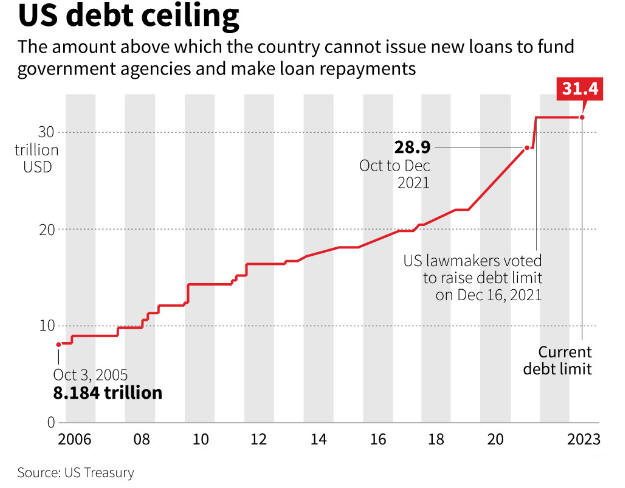

The ongoing debt ceiling negotiations in Washington continue to make investors nervous, especially after U.S. Treasury Secretary Janet Yellen expressed concerns that a default on government debt could leave millions of Americans without income payments, potentially triggering a recession that could destroy many American jobs and businesses.

President Joe Biden and House of Representatives Speaker Kevin McCarthy met this week to discuss out details of an agreement to raise the U.S. debt ceiling to avoid a catastrophic default in the face of a looming deadline. Tom Hainlin, national investment strategist at U.S. Bank Wealth Management, added:

“There is a question of whether there’s enough time to get a full deal done rather than a temporary extension, but it doesn’t mean they can’t come to an agreement in a few weeks. It’s just the timeline is more compressed this time, and these negotiations play out in the public sphere, and that leads to increased volatility until we get to an agreement.”

According to the latest news, President Joe Biden and Kevin McCarthy progressed in talks to determine whether to increase the U.S. debt limit. At the same time, a White House spokesperson said this Wednesday that President Biden would continue to hold talks with congressional leaders on the nation’s debt limit later this week.

Regional banking fears, tough Fed talk, and rhetoric over the debt ceiling from politicians will continue to influence the financial markets in the weeks ahead. The federal funds rate is now from 5% to 5.25%, the highest level since 2006, and the U.S. Central Bank warned that tighter credit conditions for households and businesses are expected to weigh on economic activity.

Higher interest rates encourage saving over spending and make the debt more costly, and recent comments from Fed officials suggested they are not ready to cut rates soon. At the same time, disappointing earnings forecasts from Home Depot and U.S. retail sales data for April have pointed to softer consumer spending. It is important to mention that government data showed recently that economic growth in the first quarter slowed sequentially, with real gross domestic product increasing at a 1.1% annual pace, compared with a 2.6% gain in the prior three-month period.

There are currently too much important things that could easily go wrong, and I would not be surprised to see a big sell-off in financial markets if something goes wrong. The upside potential for stocks and cryptocurrencies probably remains limited for the weeks ahead, and a recommendation is that investors should continue to take a defensive investment approach.