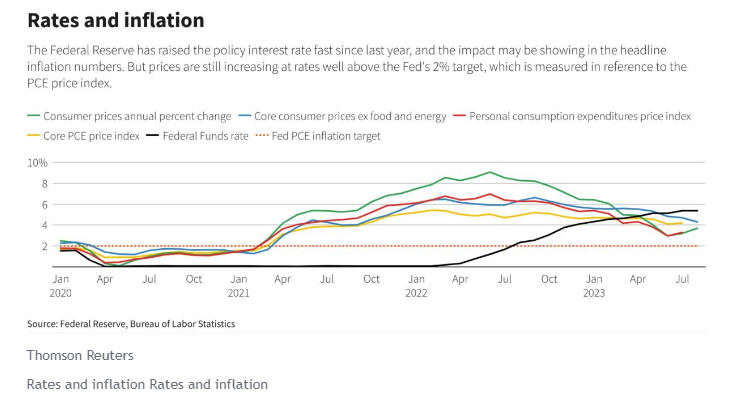

The U.S. Bureau of Labor Statistics released its August inflation report this Wednesday, and the report showed that the Consumer Price Index (CPI), which measures prices that urban consumers pay for a basket of goods and services, rose 0.6% in August. It is important to say that this increase represents the biggest monthly rise since June 2022, which could raise concerns for some Federal Reserve members. On a year-over-year basis, the headline inflation rose 3.7% against economists’ estimate of a 3.6% rise, while the core measure, which excludes volatile food and energy prices, climbed in line with expectations at 4.3%.

Food inflation was flat on a month-over-month basis at 0.2%, while growth in energy prices jumped to 5.6% from July’s 0.1% gain. The ‘hot’ August inflation report breaks a string of three consecutive months of easing inflation pressures in the United States, and the new inflation data could give the Fed reason to debate whether any further rate hikes are needed. Many analysts agree that rate hikes are not completely off the table for the rest of the year, while a Reuters poll showed that the Fed is unlikely to cut rates before the April-June period next year.

The next Federal Reserve meeting is scheduled for September 20, and according to a survey from the CME Group, markets are pricing a 97% chance that Fed policymakers will keep interest rates at the current levels. Oxford Economics Lead U.S. Economist Nancy Vanden Houten said:

“The uptick in the core CPI is a reminder that the risks remain tilted toward additional rate hikes. However, a slowing economy, loosening labor market conditions, and moderating wage growth will support a deceleration in inflation and enable the Fed to keep policy steady” until it begins gradually cutting rates in mid-2024.

Federal Reserve Chair Jerome Powell also warned recently that the U.S. central bank is “prepared” to increase interest rates further if needed as it seeks to bring inflation down to its 2% target. The next Federal Reserve policy meeting will be at the center of attention in September 2023, but investors will also have a focus on August producer prices and retail sales data on Thursday. The federal funds rate is now in a range of 5.25% to 5.50%, which is the highest level in 22 years, and in the days ahead, stock and cryptocurrency markets will be hypersensitive to any FED comments.

At the same time, September has been the worst-performing and most frequently negative month over the past century for stocks, while the most significant market crashes, such as the Great Depression in 1929 and the 2008 financial crisis, occurred in September. There are currently too many important things that could easily go wrong, and I would not be surprised to see a big sell-off in financial markets if something goes wrong. The upside potential for stocks and cryptocurrencies probably remains limited for the weeks ahead, and a recommendation is that investors should continue to take a defensive investment approach.