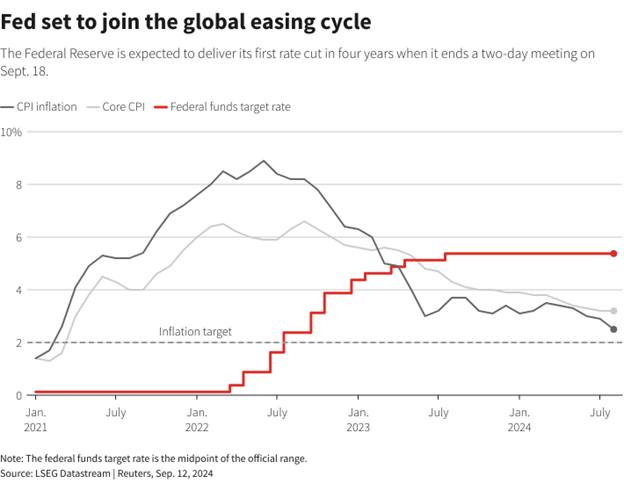

The Federal Reserve is gearing up for a potentially significant rate cut this week, marking the end of a 30-month tightening cycle aimed at curbing post-pandemic inflation. This move comes against a backdrop of weakening Chinese economic data and heightened political tensions in the U.S., setting the stage for a week of high-stakes financial maneuvering.

Investors are laser-focused on the possibility of a more aggressive 50 basis point cut, rather than the previously expected 25 basis points. As reported by Reuters, this shift in expectations has been fueled by recent press reports, despite Fed officials maintaining their traditional pre-meeting silence. The anticipation is palpable in the markets, with Wall Street benchmarks hovering within 1% of record highs and Fed futures pricing in a 60% chance of a 50 basis point cut. Short-term Treasury yields have retreated to 2022 levels, while the dollar index is approaching year-lows.

The potential Fed easing is having far-reaching effects across global markets. The yen has strengthened past 140 per dollar, a level not seen since July 2022, while MSCI’s emerging market currency index hit a record high. In the bond market, the 2-to-10-year yield curve gap is at its most positive since June 2022, reflecting shifting expectations about future economic conditions.

See Related: Riddle& Code ignites the fourth industrial revolution by easily onboarding any machine onto Web3

U.S. Markets And Industrial Output

While U.S. markets brace for easing, China grapples with economic headwinds. Industrial output growth slowed to a five-month low in August, while retail sales and new home prices missed forecasts.

Perhaps most alarmingly, new home prices fell at the fastest pace in over nine years, underscoring the ongoing property market crisis. These indicators highlight the growing need for substantial government stimulus, which has been notably absent thus far.

Adding to the complex economic landscape, the FBI reported a second failed assassination attempt on Republican presidential candidate Donald Trump. This development comes as Trump trails Democratic candidate Kamala Harris in betting markets following their recent TV debate, further complicating the political and economic outlook.

As the Fed prepares to move, market watchers are keenly awaiting the ripple effects across global economies. The interplay between monetary policy, geopolitical events, and economic indicators will likely shape market trajectories in the coming months. The Fed’s decision this week could set the tone for global monetary policy, potentially influencing central bank decisions worldwide. Moreover, China’s economic challenges present a wildcard that could significantly impact global growth prospects.

Investors and policymakers alike will be closely monitoring how these interconnected factors unfold, potentially reshaping the global economic landscape in the latter half of 2024 and beyond. The coming weeks may prove crucial in determining whether the Fed’s anticipated rate cut can stimulate growth without reigniting inflationary pressures, all while navigating the complex terrain of international economic relations and domestic political uncertainties.