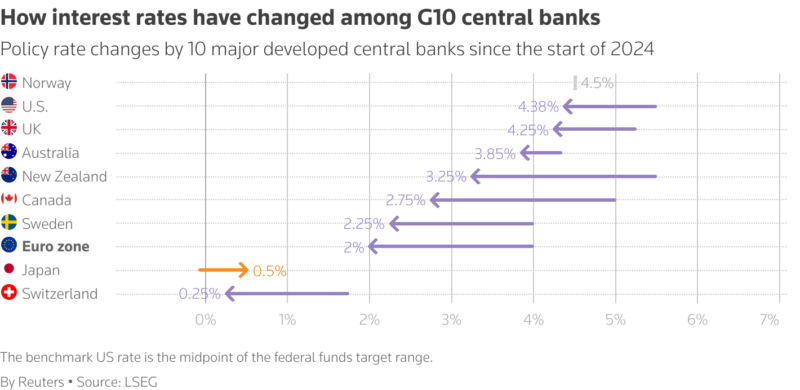

The European Central Bank (ECB) has likely taken one of its final steps in the current cycle of interest rate cuts. On Thursday, the ECB announced a quarter-point cut, bringing rates down to 2%, but the bigger news came from ECB President Christine Lagarde’s comments afterward. She described the bank as being in a good place, sparking speculation that Europe’s aggressive monetary easing is drawing to a close.

This seemingly modest statement had a big impact. The euro surged to its highest level in six weeks against the dollar, gaining more than half a percent to reach $1.1481. At the same time, yields on short-term government bonds in the eurozone rose sharply, reflecting traders’ growing belief that further rate cuts may no longer be on the table. Specifically, the yield on Germany’s two-year bonds jumped by 8 basis points, marking the biggest daily increase in over three weeks.

Before Lagarde’s statement, there was nearly a 30% chance of another rate cut in July. Now, that probability has dropped to around 20%. Markets initially focused on the ECB’s decision to lower its inflation projections, but Lagarde’s tone quickly became the main story. Her comment that the ECB is well-positioned to deal with global uncertainty — especially in light of U.S. tariff threats — sent a clear signal to investors: Europe may be done with rate cuts for now.

See Related: Economist Huang Yiping Urges China To Re-Evaluate Its Cryptocurrency Ban

For context, this has been the most aggressive round of rate cuts since the 2008-2009 financial crisis. While another rate cut this year isn’t entirely off the table, analysts believe the ECB is preparing for a long pause, unless a major external shock — like a tariff war or a financial crisis — forces a different course.

Economists And Investors’ Remarks

Economists and investors alike took Lagarde’s remarks seriously. Aviva Investors’ Vasileios Gkionakis said the central bank is likely done, barring a major surprise. Commerzbank’s Michael Pfister added that the euro’s strength reflects the ECB’s unexpectedly firm stance. Fidelity International’s Becky Qin even suggested the euro could continue to benefit as European investors start bringing money back from overseas, especially from the United States.

The numbers also support the ECB’s cautious optimism. Inflation in the euro area slowed to 1.9% in May from 2.2% in April, while oil prices — a key inflation driver — are down 13% this year. Meanwhile, the euro’s trade-weighted exchange rate has risen nearly 4%, adding further downward pressure on inflation.

However, there are still risks ahead. The most unpredictable factor is U.S. trade policy. Although President Trump recently delayed imposing steep tariffs on EU imports, tensions remain. A new deadline for trade talks looms in July, and any breakdown in negotiations could throw a wrench into the ECB’s current plans.

At the same time, government spending in countries like Germany and the possibility of new trade barriers could push inflation higher in the medium term. That’s why some ECB officials are urging caution. Despite downward revisions to both growth and inflation forecasts, the bank remains focused on the data and ready to adapt if needed.

European stock markets showed mixed reactions. The broader index trimmed its losses, while banking stocks rallied, a sign that investors are preparing for interest rates to stay where they are — or possibly start climbing again in the future.

Looking ahead, the big question is whether this moment marks a true turning point. The ECB now expects the eurozone economy to grow by 0.9% this year, with slightly better performance anticipated in 2026. Business activity, as measured by the closely watched composite PMI, is hovering near the neutral mark of 50 — indicating neither expansion nor contraction. It’s not a booming recovery, but it’s far from collapse.

From a futuristic perspective, the ECB’s current position sets the stage for a new era in European monetary policy. If inflation stays subdued and growth continues steadily, the bank may enter a prolonged phase of stability. However, if global trade tensions reignite or if economic shocks arise from unexpected corners — like geopolitical conflicts or energy supply disruptions — the ECB could be forced to reconsider its stance.

There’s also the digital euro and the growing role of green investments, both of which could reshape the economic landscape and influence future rate decisions. For now, though, the message is clear: Europe’s central bankers believe they’ve done enough, and they’re ready to wait, watch, and respond — rather than lead with further cuts.

As we move through 2025, all eyes will be on inflation trends, U.S. trade policy, and the resilience of European growth. The next few months could set the tone for years to come in how the ECB navigates an increasingly uncertain world.