In a bold move that’s turning heads in the financial world, Barclays has announced a hefty £750 million ($957 million) share buyback program and raised its long-term earnings forecast. This comes despite a 9% drop in profits for the first half of 2024, as reported by Reuters.

The British banking giant is now aiming for a return on tangible equity (ROTE) exceeding 12% by 2026, a significant jump from its previous target of 10%-plus for 2024. Barclays is also setting its sights on generating a whopping £30 billion in annual income by 2026.

But that’s not all. In a move that’s music to shareholders’ ears, Barclays plans to return at least £10 billion to investors between 2024 and 2026 through dividends and share buybacks. This aligns with a trend seen across the sector, with HSBC and Standard Chartered making similar commitments.

While Barclays’ shares dipped 1.5% amid a broader market selloff, it’s worth noting that the stock has surged over 50% this year. This impressive rally followed CEO C.S. Venkatakrishnan’s February announcement of a major strategy overhaul, focusing on growing the bank’s core UK lending businesses.

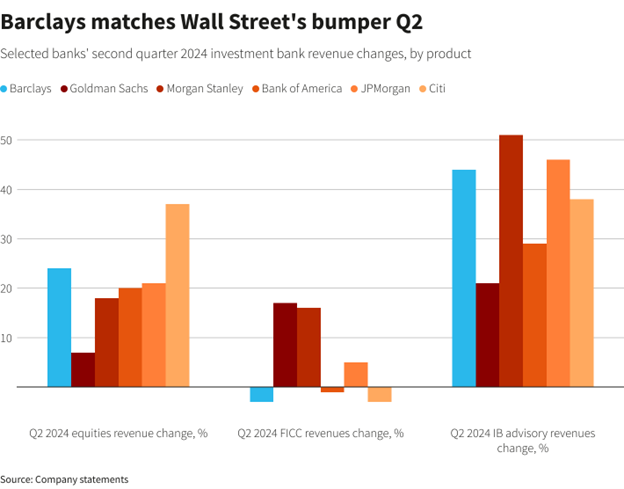

Interestingly, despite the shift in focus, it was Barclays’ investment bank that stole the show this quarter. The division saw a 10% rise in income, primarily driven by a stellar performance in equities trading. In fact, Barclays outpaced several Wall Street rivals, with its 24% increase in equities income beating the likes of Morgan Stanley, Goldman Sachs, and JPMorgan.

However, it wasn’t all smooth sailing. The bank’s UK corporate division saw its return on tangible equity plummet to 16.6% from 27.3% a year ago, with pretax profits sinking 36%. The retail banking arm also faced headwinds, with revenues falling 4% as competition in lending intensified.

See Related: Barclays Eyes Tesco Bank Acquisition In Push For Retail Banking Growth

Bank Of England And Potential Base Rate Cut

As the Bank of England considers a potential base rate cut, Barclays remains optimistic about its interest income. The bank has actually raised its forecast for 2024 net interest income to £11 billion, up from £10.7 billion.

Looking ahead, Barclays’ ambitious plans and strong performance in certain sectors paint a picture of a bank ready to navigate the choppy waters of global finance. The increased focus on shareholder returns and the upgraded earnings guidance suggest confidence in the face of challenges.

However, the mixed results across different divisions highlight the complex landscape Barclays must navigate. The success of its investment banking arm, particularly in equities trading, provides a strong foundation. Yet, the pressures on its UK retail and corporate banking sectors cannot be ignored.

As global economic uncertainties persist and interest rate dynamics evolve, Barclays’ ability to balance its diverse portfolio will be crucial. The coming years will test the bank’s strategic pivot and its capacity to deliver on its ambitious targets. For now, Barclays seems to be betting big on its ability to weather the storm and emerge stronger on the other side.