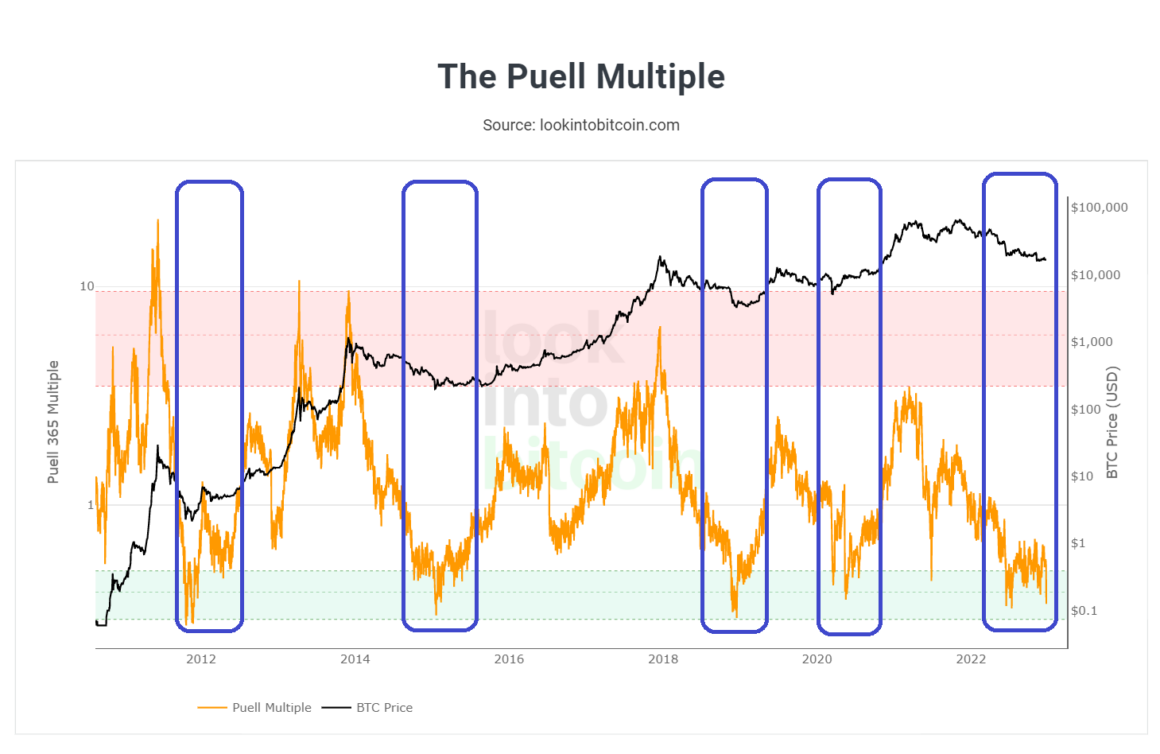

Based on the data presented by The Puell Multiple, bitcoin’s current price has touched the baseline range of the indicator.

Historically, when the value of Puell Multiple visits the lower zone, the bitcoin price hits its ‘bottom’. According to the chart, bitcoin began to recover when its price began to retract away from the bottom area. This behavior has been observed four times in the history of bitcoin. Since the revisit of the zone last June 16, 2022, the indicator has begun to exhibit the same behavior as before.

David Puell, an on-chain researcher at ARK Invest, developed the ‘The Puell Multiple’ indicators. This indicator employs the top red zone to indicate when miner revenue is significantly higher while the lower green zone represents revenue loss. Many investors have used this signal to predict the bottom of the bitcoin market.

David Puell recently tweeted his thoughts on the current market sentiment. He said that “three factors are needed for a bull” market to start. And as of now, item number 1 and 2 is evident, while the third item is currently “underwhelmed”.

See Related: Bitcoin Wallet Addresses Holding More Than 10 BTC Soar