The factors which determine the size of a Bitcoin transaction and the fee associated with it are inputs and outputs.

When you purchase Bitcoin, every separate transaction is stored as you bought it, coins do not technically stack up like they appear to do in your wallet. If you buy 1 BTC in transaction A (TA) and 3 BTC in transaction B (TB), trying to send 2 BTC can either take 1 BTC from TA and 1 from TB or 2 BTC from TB.[1]Bitcoin Wiki – How much will the transaction fee be? / Why is the fee so high? These are referred to as input coins.

With option A when coins are split and sent, they count as 2 different input coins. In comparison option B would count as one input coin. Input coins are around 5x larger than output coins. [2]Bitcoin Wiki – How much will the transaction fee be? / Why is the fee so high? If you have a lot of bitcoin stored in your wallet from small transactions, then more inputs are required to send the coins, in turn increasing your transaction size and mining fee.

Why Are Bitcoin Transaction Fees So High?

The average size of a bitcoin transaction was around 250 Bytes in 2014, [3]Bitcoin Forum – Gavin Andresen: “Re: A Scalability Roadmap“ whereas the average size of a Bitcoin transaction is around 580 Bytes in 2022. [4]TradeBlock – Bitcoin Historical Data Bitcoin clients will fill their block up with ~50KB of high-priority transactions and ~700KB of highest-fee-per-KB transactions.[5]Gavin Andresen, GitHub/Bitcoin – Transaction Fees

With the traction Bitcoin has gained over the last few years there have been many newcomers to the industry. Those new to crypto may not want to go all in straight away, so they dollar-cost average with small Bitcoin purchases every week. But when they decide to transact this Bitcoin, they’re hit with high fees. The reason behind this is they have so many small inputs worth of coins that it takes much more computational power to verify the transaction. These transactions with higher fees are prioritized by miners as stated above, which accounts for the increase in the average block size and cost of Bitcoin transactions increasing over 200% in the last 8 years.

Average Bitcoin Transaction vs Large Bitcoin Transaction

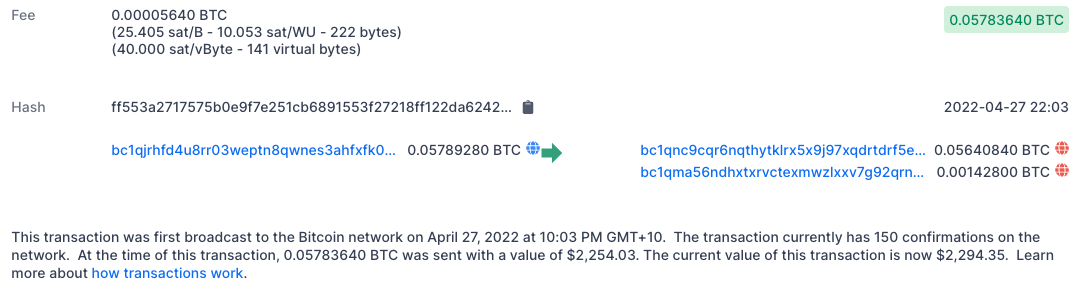

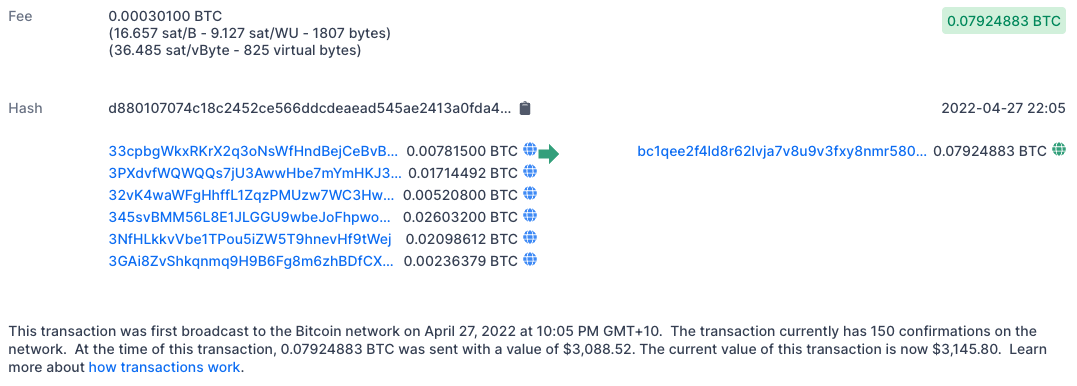

Comparing Transaction X (TX) to Transaction Y (TY) below you can see that TX had a lower transaction fee compared to TY.

Transaction X sent 0.05783640 BTC which went through in a single input, although left in two outputs. The transaction fee for this was 0.00005640 BTC.

Transaction Y sent 0.07924883 BTC which went through in 6 different inputs and left in one output. The transaction fee for this was 0.00030100 BTC.

You can clearly see that with TY, to get the full 0.07924883 BTC being sent 6 different smaller amounts of BTC had to be verified, using more computational power and therefore costing more to send.

References