Cryptocurrency exchange KuCoin has released a report titled ‘Into the Cryptoverse 2022’ and found that almost half of Germans are motivated to invest in cryptocurrencies.

Adoption Of Cryptocurrencies In Germany

The report found that 44% of Germans are motivated to invest in cryptocurrencies to “be a part of the future of finance” and hope to become financially independent with the help of cryptocurrencies to improve their family’s living conditions.

30% consider crypto as a reliable store of value whereas 35% of them would do it for the opportunity to earn a passive income. To add, 16% of the country’s population (18 – 60 yrs old) have already invested in crypto or have been trading it within the past six months. Out of those expressing their interests, 77% of the ‘crypto-curious’ are researching potential assets to invest in and 31% of the same group plans to start lending their cryptocurrencies through staking.

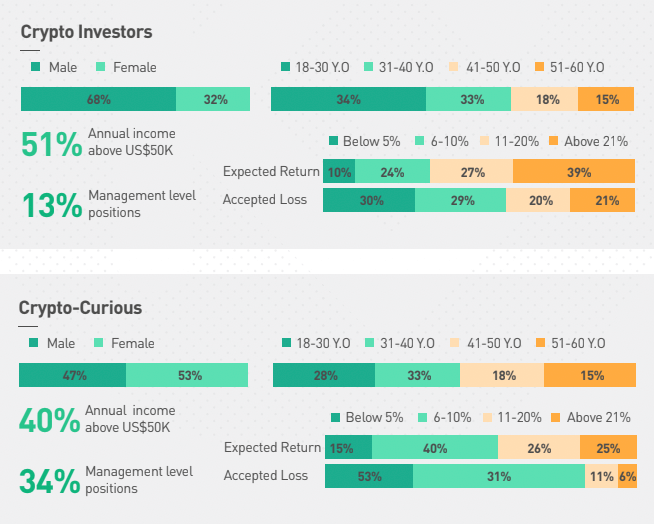

The report also found that “69% of crypto investors are men, while women account for 53% of the crypto-curious.” This shows the growing interest in cryptocurrencies in German females. BlockFi found that in the U.S.A. almost a third of women were planning to invest in crypto by the end of the year.

Profile of Crypto Investors & Crypto-Curious

Crypto Regulation In Germany Is A Work In Progress

CEO of KuCoin Johnny Lyu belives the report clearly highlights the growing demand for cryptocurrencies within Germany.

The German government were the first one to recognize Bitcoins as a “unit of value and could be classified as a financial instrument,” although they have had only “some success in regulating crypto,” states Lyu.

The official report reads that it is “easy for individuals to invest in cryptocurrency” in Germany and crypto gains are tax exempt if they’ve been held for over a year.

“Cryptocurrencies are very popular among the supporters of the accumulation strategy, especially among the younger generation. They prefer to save for retirement on their own and diversify their savings through the use of cryptocurrencies.”

Into the Cryptoverse Report