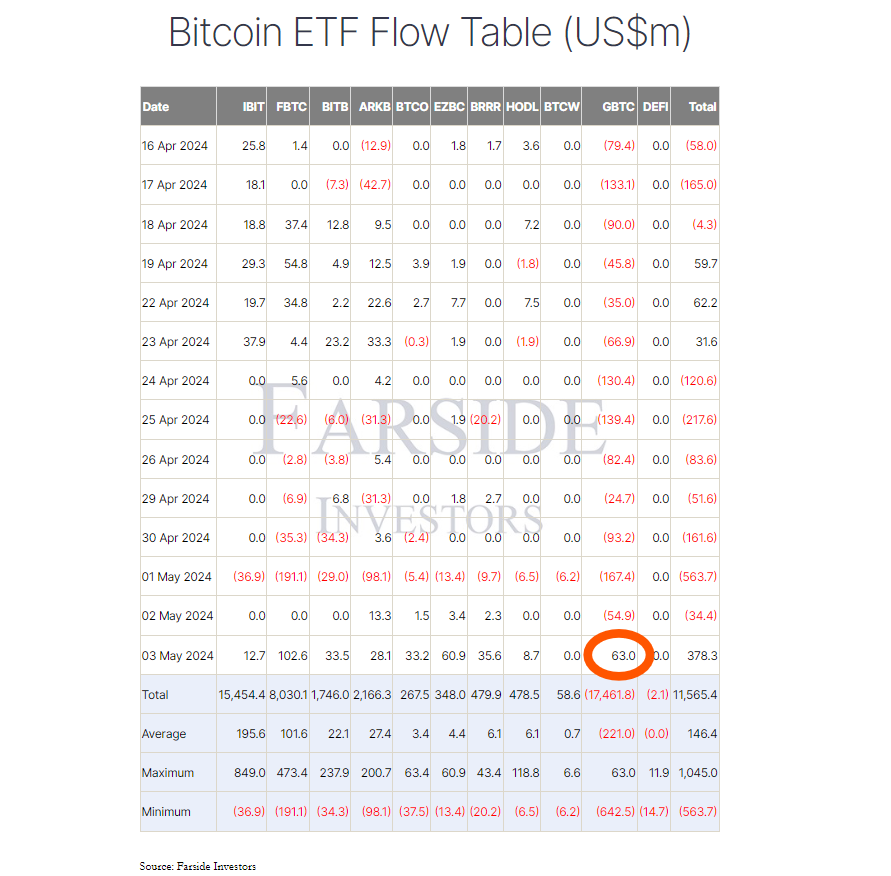

The Grayscale Bitcoin Trust ETF ($GBTC) recently experienced a shift in its financial trend. It registers an inflow of $63 million and breaks an 11-week rally of net losses according to the Farside Investors.

Bloomberg ETF analyst Eric Balchunas expressed his surprise on Twitter, stating, “Holy crap $GBTC had inflows today,” and noted that their nearly 80-day streak of outflows had ended. He humorously remarked on the significance of this change, asking his followers to rate how significant this turnaround was for GBTC.

Despite these challenges, GBTC remains the largest Bitcoin spot ETF, managing over $18.7 billion in assets and holding approximately 297,000 Bitcoin. However, consistent withdrawals have allowed new entrants like the BlackRock iShares Bitcoin Trust (IBIT), which now has $17.2 billion in assets, to narrow the gap.

This news comes shortly after a downturn for IBIT, which saw a reduction of $37 million just a day earlier, as per Farside Investors. This event was part of a broader trend that saw the ETF market experience its worst day ever, with a total outflow of $563 million amid a decline in Bitcoin prices.

See Related: GBTC Price Prediction after Judges Raised Hope for Investors In Favour Of Grayscale

Bitcoin ETF in Asia

Hong Kong has recently made strides in the cryptocurrency market with the introduction of spot exchange-traded funds (ETFs) for Bitcoin and Ethereum. This development reflects Hong Kong’s growing embrace of digital currencies and its ambition to become a major hub for cryptocurrency trading and finance.

The trading started last April 30 and shows $12 million in trading volume on its first day. Bitcoin spot ETF recorded a $8.5 million and Ethereum spot ETF $2.5 million in trading volume.