Wall Street stocks fell on Thursday as the newest economic data showed that the U.S. economy grew at its slowest pace in nearly two years in the first quarter while inflation accelerated. At the same time, disappointing results from Meta, whose shares weakened more than 10%, also weighed on market sentiment. James St. Aubin, chief investment officer at Sierra Mutual Funds in California, said:

“The GDP numbers definitely put a ding in the paradigm that markets were hanging onto for equities in terms of high growth; and if you don’t have high growth that will translate to lower-than-expected earnings.”

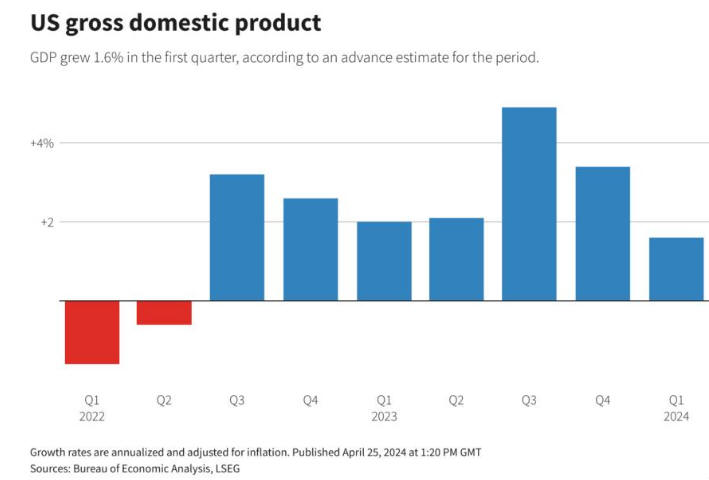

The Commerce Department reported that the U.S. economy grew at a 1.6% annualized rate in the first quarter of 2024 while analysts had expected a 2.5% pace of first-quarter growth. The rise in GDP was mainly due to increases in consumer spending, residential fixed investment, nonresidential fixed investment, and state and local government spending, partially offset by a reduction in private inventory investment.

By comparison, gross domestic product (GDP) increased at a 3.4% annual rate in the fourth quarter of 2023 and rose 4.9% in the three months before that. This latest GDP report is the freshest sign that the economy is cooling off, even as inflation stays firm and stickier inflation is pushing off expectations about when and how much the Federal Reserve will slash interest rates this year.

See Related: Wall Street’s Main Indexes Fell At The Beginning Of 2024

Monetary Policy And Inflation

Federal Reserve Chair Jerome Powell said last week that recent inflation data had not given policymakers enough confidence to ease monetary policy soon, noting that the U.S. central bank may need to keep interest rates higher for longer than previously thought. The March Personal Consumption Expenditures (PCE) index, the Fed’s preferred inflation gauge, is due on Friday but according to LSEG data, money markets are currently anticipating approximately 36 basis points of Federal Reserve rate cuts for this year, which represents a significant decrease from the roughly 150 basis points expected at the beginning of the year.

CME Group’s FedWatch tool also reported that traders significantly reduced their expectations for a July rate cut as they believe that the Fed wants to see more data points to give them confidence they’ll achieve their 2% inflation goal. It is also important to mention that the number of Americans who filed new claims for unemployment benefits dropped unexpectedly last week, indicating that labor market conditions remain tight.

Traders are currently trying to balance this two-sided narrative: the U.S. economic situation, which still does not point to recession, and at the same time the inflation picture, and interest rates, which will eventually be problematic for the stock market. Simultaneously, the increase in geopolitical uncertainties presents an extra hurdle and amplifies the possibility of unexpected risks in both markets and economic outcomes. The recommendation for investors is to take a defensive approach in the weeks ahead.