Wall Street’s major indexes recovered on Tuesday from the previous losses as chip stocks gained ground from previous declines as Nvidia rebounded, and investors turned their attention to the conclusion of the Federal Reserve’s policy meeting on Wednesday, seeking insights into interest rate policy.

It is important to mention that Nvidia shares bounced back from previous declines following the announcement of pricing and shipping details for its highly anticipated Blackwell B200 artificial intelligence chip, which it says to be up to 30 times faster than its existing chips.

The focus of investors is currently on a press conference from Chair Jerome Powell and every information that the Federal Reserve could begin to lower interest rates would be beneficial for stock markets. Gene Goldman, chief investment officer at Cetera Investment Management, said:

“There’s optimism that the Fed’s not going to surprise us a lot on Wednesday. We think three cuts are still on the table even though robust inflation data has pulled back bets for the first rate cut in June to about 59.6% from about 69% at the start of last week, according to the CME FedWatch Tool.”

Gene Goldman also added that he anticipates that Powell will reiterate his cautious stance on inflation to the market, emphasizing that policy decisions will be contingent upon economic data. Furthermore, he expects the central bank to revise its projections for both inflation and economic growth.

See Related: U.S. Stocks Rose On Wednesday. The Focus Of Investors Now Turns To Inflation Reports And Major Bank Earnings

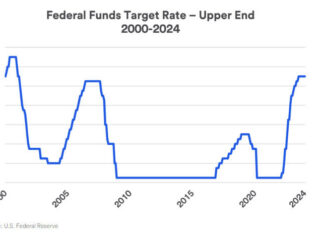

Federal Funds Rates 2024

So far into 2024, the Fed funds rate has remained paused at a range of 5.25%-5.50% and many central bank officials want to see a clear disinflationary trend in the data before cutting rates. Traders currently expect that the Federal Reserve will cut rates at least two times this year but some economic analysts say that the Fed may face a difficult task in reacting to shifts in economic data without creating any large surprises too close to November’s U.S. elections. Matt Eagan, head of the full direction team at Loomis, Sayles & Co., said:

“They don’t want to be in a position where they are doing something offside during an election that could be perceived to be influencing one party or the other”

Markets have rallied this year on bets that the Fed would start trimming rates in the first half of the year but some Federal Reserve governors warned last month that the interest rate cuts expected by the market in the first half of the year may have been premature. Considering these elements, the outlook is expected to remain cautious as long as interest rates remain significantly restrictive and the looming presence of geopolitical risks persists.