Wall Street’s main indexes tumbled on Tuesday following a consumer inflation reading that surpassed expectations, leading to a shift in market sentiment regarding imminent interest rate cuts and driving U.S. Treasury yields upward.

Markets have rallied this year on bets that the Fed would start trimming rates in May but a Labor Department report showed U.S. consumer prices increased above forecasts in January amid a surge in the cost of shelter. Bob Elliott, chief investment officer at Unlimited Funds said:

“Some Federal Reserve governors have come out in the last couple of weeks and given various indications that the interest rate cuts expected by the market in the first half of the year may have been premature. Now the CPI data are certainly reaffirming that picture.”

Consumer price growth reaccelerated, with the main headline figures rising at a faster pace than economists forecast and January’s surprisingly strong core CPI print shows the road to durably return to 2% inflation will be bumpy.

See Related: Macro Review Of Economic Data For The United States; CPI, Inflation, Fund Rates

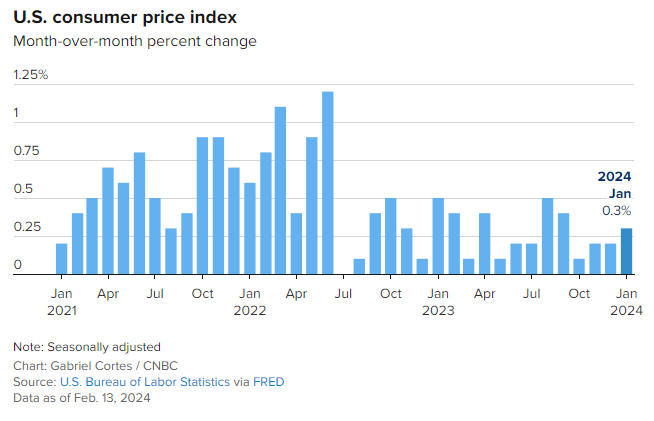

Consumer Price Index

The consumer price index increased 0.3% in January and it is important to say that shelter prices accounted for much of the rise, climbing 0.6% on the month, contributing more than two-thirds of the headline increase.

On a 12-month basis, the consumer price index came out to 3.1%, down from 3.4% in December but economists surveyed by Dow Jones had been looking for a monthly increase of 0.2% and an annual gain of 2.9%.

Excluding the volatile food and energy prices, the core CPI surged by 0.4% in January and increased by 3.9% compared to a year ago, remaining unchanged from December. The forecast had anticipated 0.3% and 3.7%, respectively.

Consequences Of Inflation

Following the inflation data release, traders’ bets on a 25 basis point rate reduction in May decreased to 38%, down from approximately 58% before the data. Meanwhile, expectations for June remained at 75%, as indicated by the CME FedWatch tool. Quincy Krosby, chief global strategist at LPL Financial said:

“The much-anticipated CPI report is a disappointment for those who expected inflation to edge lower allowing the Fed to begin easing rates sooner rather than later. Across the board, numbers were hotter than expected making certain that the Fed will need more data before initiating a rate cutting cycle.”

Outside of the jump in shelter costs, the rest of the inflation picture was a mixed bag. Prices for used vehicles dropped by 3.4%, while apparel costs decreased by 0.7%, and medical commodities experienced a 0.6% decline. Conversely, electricity costs saw a 1.2% rise, and airline fares increased by 1.4%.

In the grocery aisle, ham prices decreased by 3.1%, whereas egg prices surged by 3.4%. Federal Reserve officials anticipate inflation to retreat to their 2% annual target but January’s uptick could pose challenges for a central bank aiming to ease its tightest monetary policy stance in over two decades.