This Tuesday, the Federal Reserve commenced a two-day gathering to discuss monetary policy. It is widely anticipated that after this meeting, the central bank will keep interest rates unchanged, as indicated by the CME Group’s FedWatch tool.

The crucial factors in determining the duration of the restrictive monetary policy will be the Federal Reserve’s statements on Wednesday and the monthly job report scheduled for Friday. Hugh Johnson, chairman and chief economist of Hugh Johnson Economics, said:

“Everyone’s waiting for the Federal Reserve’s decision and the employment report on Friday. Investors since late July have become worried because the possibility of a hard landing has increased and that’s why today there’s so much attention on the Fed.”

Sam Stovall, the chief investment strategist at CFRA Research, noted that while hardly anyone anticipates an interest rate increase in November, the likelihood of the Federal Reserve raising rates in December is increasingly uncertain. The latest economic data showed a solid increase in U.S. labor costs in the third quarter which added concerns that the Fed could keep interest rates higher for longer and even increase rates one more time by the end of 2023.

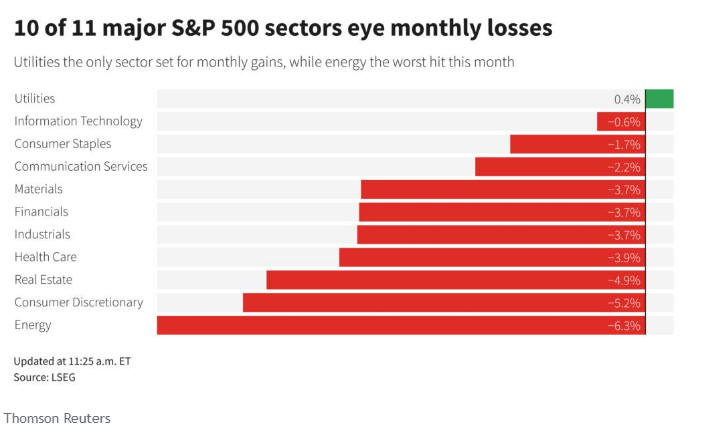

This situation poses challenges for companies with substantial credit or variable interest rate loans. Increased borrowing expenses will negatively impact corporate earnings and deter businesses from seeking loans to support new ventures, potentially hampering economic growth and job opportunities. It is important to note that U.S. equities are tracking their third straight month of losses, with the S&P 500 and the Nasdaq on course for their biggest October percentage decline since 2018.

The New York Federal Reserve’s recession probability indicator indicates that there is a 56% likelihood of a U.S. recession occurring within the next year, although this figure has decreased from the 66% recorded in August. Even if the U.S. ultimately avoids a recession in the upcoming months, the Fed’s aggressive monetary policy strategy from the past year and a half may only now be starting to hurt the economy.

JPMorgan strategist Marko Kolanovic also predicts that the majority of negative consequences stemming from higher interest rates have not materialized yet. He points out a rising pattern in consumer loan delinquencies and corporate bankruptcies, indicating that these trends are likely to continue unless there is a reduction in interest rates.

At the same time, the escalation of geopolitical uncertainties introduces an additional challenge and heightens the potential for unforeseen risks in both markets and economic performance. Considering all of these factors, the perspective is likely to stay cautious as long as interest rates remain significantly restrictive and the looming presence of geopolitical risks persists.