Investor optimism is rising again after the U.S. employment report that was released this Wednesday showed that the U.S. private sector’s job growth decelerated more than expected in August. According to the report, private employment grew by 177,000 this month, below the 195,000 increase expected, driven by a sharp slowdown in the leisure and hospitality sector. On Tuesday, the Bureau of Labor Statistics reported that U.S. job openings fell in July, which also boosted optimism on the U.S. stock market as fresh economic data indicated a cooling U.S. economy, keeping alive hopes the Federal Reserve could pause rate hikes in September.

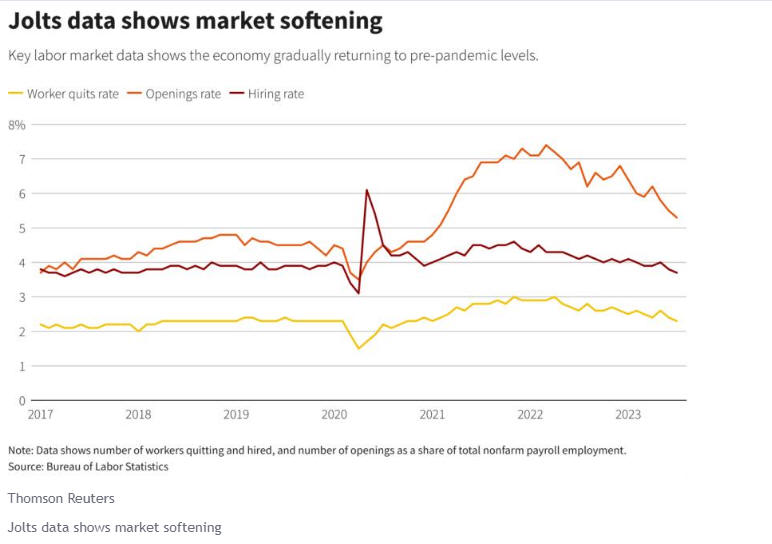

The U.S. job openings data dipped to levels not seen since early 2021 as the Labor Department’s Job Openings and Labor Turnover Survey (JOLTS) showed the number of job openings stood at 8.827 million in July, falling for the third straight month. In the meantime, fresh gross domestic product (GDP) numbers showed the U.S. economy expanded 2.1% in the second quarter, slower than a preliminary estimate of a 2.4% growth.

Wall Street’s three main indexes continue to rise this week, while Tom Lee, head of research at Fundstrat Global Advisors, said that he believes that the U.S. stock market could be supported in September as he expects incoming inflation data to show a significant slowdown in inflationary pressures. The crypto market displayed again a high correlation with U.S. equities, and if a positive trend is witnessed in the stock market, the same is usually replicated in the crypto-sphere as well. David Russell, global head of market strategy at TradeStation, said:

“We’re back to a spot now where bad news is something of good news. The most recent data really shows that the economy is not overheating, which puts us back in the situation where we don’t have as much fear of additional rate hikes at this point in time.”

The federal funds rate is now in a range of 5.25% to 5.5%, which is the highest level in 22 years, and analysts’ bets on the Fed leaving interest rates unchanged in the September meeting stand at nearly 91%, up from 88.5% before the private payrolls and GDP data were released. However, it is important to keep in mind that Federal Reserve Chair Jerome Powell warned last week that the U.S. central bank is “prepared” to increase interest rates further if needed as it seeks to bring inflation down to its 2% target. Because of this, investors should pay close attention to the personal consumption expenditures price index numbers, the Fed’s preferred measure of inflation, and non-farm payroll numbers due this Thursday and Friday, respectively, for more clues on interest rates path.