Wall Street’s three main indexes tumbled this Tuesday as financial stocks dropped after rating agency Moody’s cut credit ratings of several small- to mid-sized U.S. banks and said it could downgrade some of the country’s biggest lenders. The agency cited higher funding costs, profitability pressures, and slowing loan growth as a common theme in banks’ second-quarter earnings and said the Fed’s rate hikes will lower profitability as consumers take out fewer loans.

Rating agency Moody’s cut credit ratings of Associated Banc-Corp. (ASB), Old National Bancorp (ONB), Pinnacle Financial Partners (PNFP), BOK Financial Corp. (BOKF), M&T Bank (MTB), Webster Bank (WBS), Amarillo National Bank, Commerce Bancshares (CBSH), Prosperity Bank (PB), and Fulton Financial Corp. (FULT).

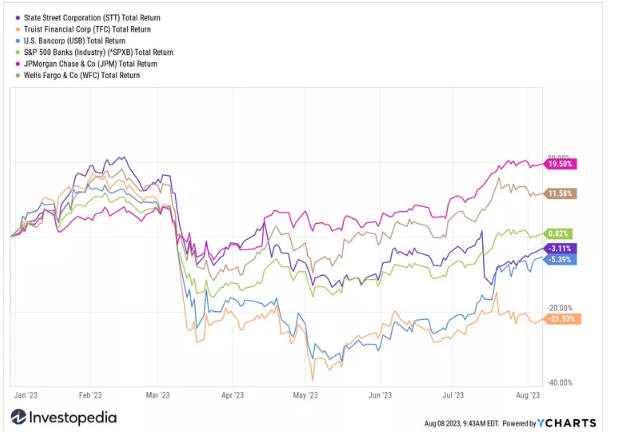

The news that scared investors, even more, is the fact that rating agency Moody’s assigned a negative outlook to six top-tier lenders – U.S. Bancorp (USB), State Street Corp. (STT), Truist Financial Corp. (TFC), Bank of New York Mellon (BK), Northern Trust Corp. (NTRS), and Cullen/Frost Bankers Inc. (CFR)—placing them on review for a potential future downgrade.

Lenders have lost 4% so far this year, compared with a 17% rise in the benchmark S&P 500 index, while the broader S&P 500 banking sector is up just under 1% so far this year, as shares of the biggest banks like JPMorgan Chase (JPM) and Wells Fargo (WFC) have outperformed their smaller counterparts.

“Anytime you see the backbone of the U.S. financial system being under watch, that gives people a lot to pause. Markets are slowly digesting that maybe the U.S. financial system is not absolutely perfect, and maybe we are going to have higher rates for a much longer period of time.”

The collapse of Silicon Valley Bank and Signature Bank earlier this year already sparked a crisis of confidence in U.S. lenders, and the negative information is that the CBOE Market Volatility Index VIX, Wall Street’s fear gauge, hit this Tuesday a two-month high at 17.71. There are currently too much important things that could easily go wrong, and it would not surprise me to see a big sell-off in financial markets if something goes wrong. The upside potential for stocks and cryptocurrencies probably remains limited for the weeks ahead, and a recommendation is that investors should continue to take a defensive investment approach.