As the earnings season commences, U.S. banks are set to report their financial performance for the April-through-June period. This quarter is especially significant as it marks the first full quarter following the collapse of Silicon Valley Bank (SVB) in mid-March. After SVB failed, worries were voiced that other regional banks could lead to a credit crunch, further straining financial conditions. However, contrary to predictions, the U.S. economy remains on solid footing.

Reuters revealed a thorough analysis of US bank credit. By examining the data provided in the report, we can better understand the trends, challenges, and opportunities within the US banking sector. Let’s delve into the details and explore the intricacies of US bank credit, shedding light on its impact on the broader economy and financial landscape.

Overall Credit Landscape

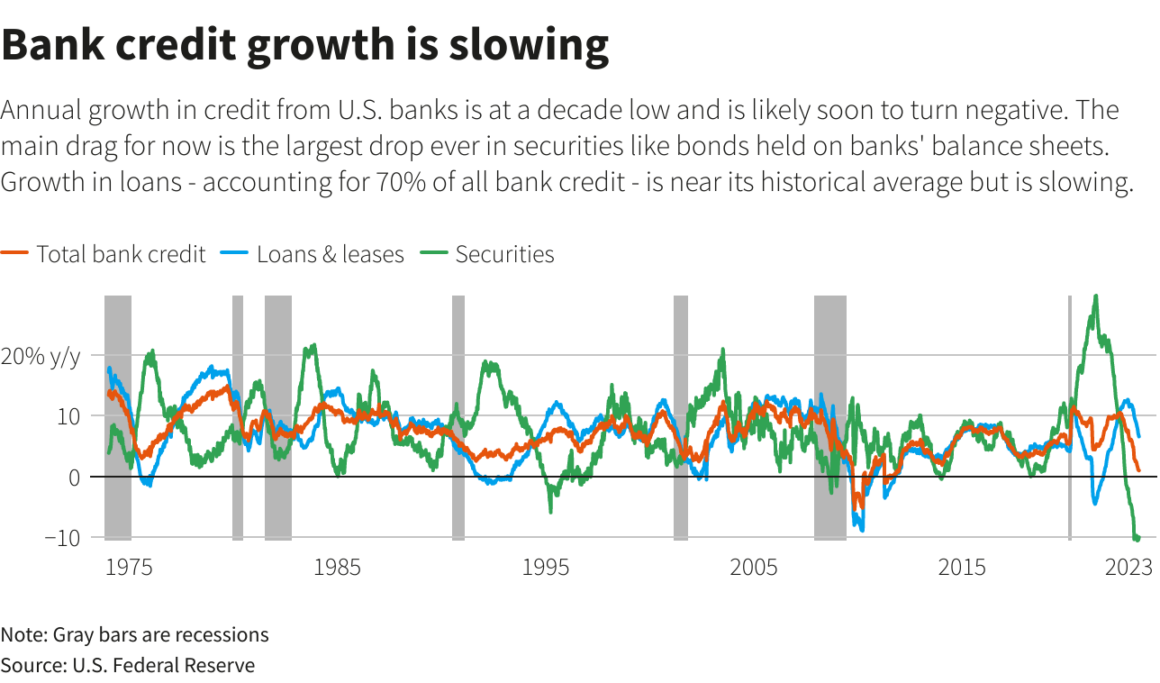

Credit growth from U.S. banks is near record lows, possibly turning negative soon. The U.S. Federal Reserve classifies bank credit into two major categories: securities and loans. Bank assets have dropped by the fastest rate ever, reaching 10% in a year. The Fed rate hikes led to decreased bond prices and are largely responsible for the decline in securities’ value.

Loans (Classification): The Federal Reserve categorizes loans into four types: Commercial & Industrial (C&I), real estate, consumer, and all other loans.

C&I loan growth decelerated to 3.4% by June-end, its lowest level in a year, contrasting with earlier double-digit increases. Consumer borrowing initially grew strongly but has since stabilized around pre-pandemic levels. Real estate loans continue to exhibit rapid growth, with an annual rate of 8%, driven by the extended boom in the housing market.

Consumer Credit: we can further divide consumer credit into three segments: credit cards, auto loans, and other consumer loans.

Bank credit card lending reached a record high of nearly $1 trillion, but its growth rate has moderated since October 2022. Auto loan growth peaked in early 2022 and turned negative in April, hitting its lowest rate (-1%) since 2015, coinciding with a drop in used car prices. In the real estate sector, residential and commercial real estate loans are rising but at a slower pace. Remote work reduced demand for office real estate, and high mortgage rates from Fed rate hikes weakened the housing market.

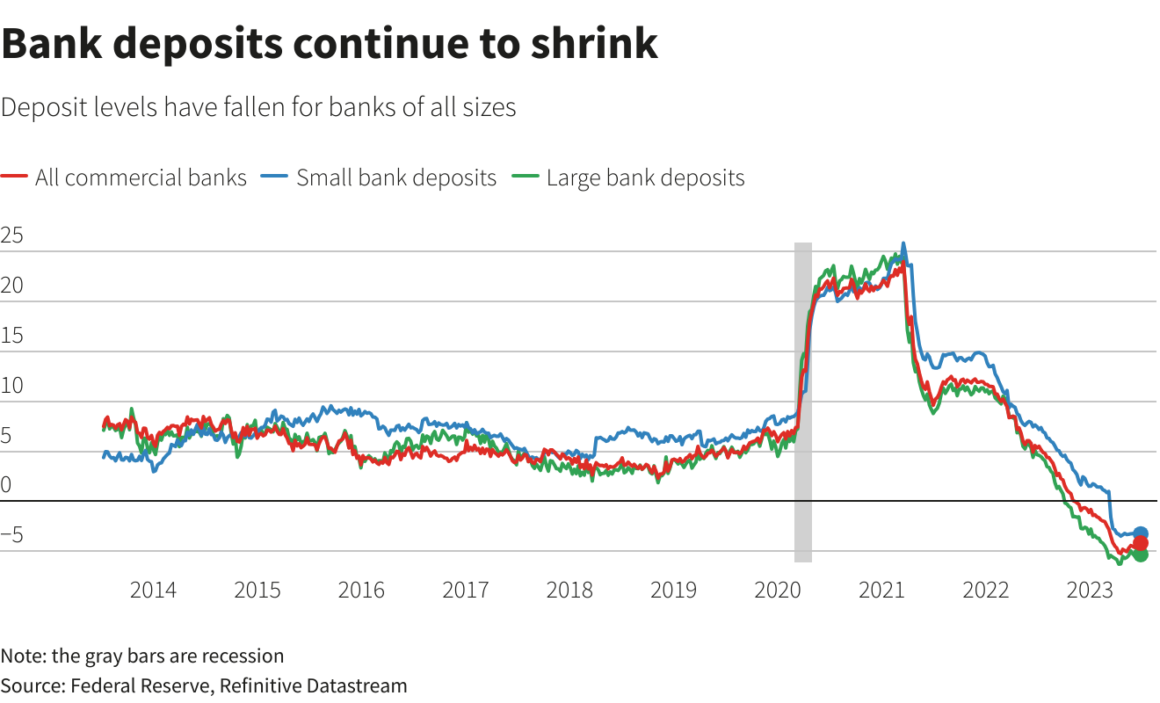

Overall Deposits

Deposits are a focal point during the reporting season due to recent bank collapses. Following the collapse of SVB and other large U.S. lenders, deposits were withdrawn, especially from smaller banks in March. Deposit levels for major banks have been declining for over a year, with negative growth since October 2022, reaching a significant decline of 6% in April. While the declines seem to stabilise, a full recovery has not been seen yet.

On The Horizon–Potential Loan Losses

Banks anticipate more loan defaults, resulting in increased loan loss reserves that have grown by over $25 billion since June of the previous year. Higher interest rates raise borrowing costs, prompting banks to prepare for potential delinquencies. Consequently, overall loan loss allowances are currently at their highest level in around 12 years, excluding the pandemic.

A slowdown in the credit growth of U.S. banks is currently in process. However, the much-anticipated credit crunch in the aftermath of the SVB collapse has not been significant. Consumer lending remains relatively strong, while certain categories of business credit have experienced more substantial deceleration. Things will become clearer when earnings reports are released and trends are highlighted, shedding more light on the developing state of the credit landscape of the U.S. banking sector.

Reuters’ report can be accessed here.